Archive for the ‘VOC’ Category

Reducing Time To Market vs. Improving Profits

X: We need to decrease the time to market for our new products.

X: We need to decrease the time to market for our new products.

Me: So, you want to decrease the time it takes to go from an idea to a commercialized product?

X: Yes.

Me: Okay. That’s pretty easy. Here’s my idea. Put some new stickers on the old product and relaunch it. If we change the stickers every month, we can relaunch the product every month. That will reduce the time to market to one month. The metrics will go through the roof and you’ll get promoted.

X: That won’t work. The customers will see right through that and we won’t sell more products and we won’t make more money.

Me: You never said anything about making more money. You said you wanted to reduce the time to market.

X: We want to make more money by reducing time to market.

Me: Hmm. So, you think reducing time to market is the best way to make more money?

X: Yes. Everyone knows that.

Me: Everyone? That’s a lot of people.

X: Are you going to help us make more money by reducing time to market?

Me: I won’t help you with both. If you had to choose between making more money and reducing time to market, which would you choose?

X: Making money, of course.

Me: Well, then why did you start this whole thing by asking me for help improving time to market?

X: I thought it was the best way to make more money.

Me: Can we agree that if we focus on making more money, we have a good chance of making more money?

X: Yes.

Me: Okay. Good. Do you agree we make more money when more customers buy more products from us?

X: Everyone knows that.

Me: Maybe not everyone, but let’s not split hairs because we’re on a roll here. Do you agree we make more money when customers pay more for our products?

X: Of course.

Me: There you have it. All we have to do is get more customers to buy more products and pay a higher price.

X: And you think that will work better than reducing time to market?

Me: Yes.

X: And you know how to do it?

Me: Sure do. We create new products that solve our customers’ most important problems.

X: That’s totally different than reducing time to market.

Me: Thankfully, yes. And far more profitable.

X: Will that also reduce the time to market?

Me: I thought you said you’d choose to make more money over reducing time to market. Why do you ask?

X: Well, my bonus is contingent on reducing time to market.

Me: Listen, if the previous new product development projects took two years, and you reduce the time to market to one and half years, there’s no way for you to decrease time to market by the end of the year to meet your year-end metrics and get your bonus.

X: So, the metrics for my bonus are wrong?

Me: Right.

X: What should I do?

Me: Let’s work together to launch products that solve important customer problems.

X: And what about my bonus?

Me: Let’s not worry about the bonus. Let’s worry about solving important customer problems, and the bonuses will take care of themselves.

Image credit — Quinn Dombrowski

X: Me: format stolen from @swardley. Thank you, Simon.

What should we do next?

Anonymous: What do you think we should do next?

Anonymous: What do you think we should do next?

Me: It depends. How did you get here?

Anonymous: Well, we’ve had great success improving on what we did last time.

Me: Well, then you’ll likely do that again.

Anonymous: Do you think we’ll be successful this time?

Me: It depends. If the performance/goodness has been flat over your last offerings, then no. When performance has been constant over the last several offerings it means your technology is mature and it’s time for a new one. Has performance been flat over the years?

Anon: Yes, but we’ve been successful with our tried-and-true recipe and the idea of creating a new technology is risky.

Me: All things have a half-life, including successful business models and long-in-the-tooth technologies, and your success has blinded you to the fact that yours are on life support. Developing a new technology isn’t risky. What’s risk is grasping tightly to a business model that’s out of gas.

Anon: That’s harsh.

Me: I prefer “truthful.”

Anon: So, we should start from scratch and create something altogether new?

Me: Heavens no. That would be a disaster. Figure out which elements are blocking new functionality and reinvent those. Hint: look for the system elements that haven’t changed in a dog’s age and that are shared by all your competitors.

Anon: So, I only have to reinvent several elements?

Me: Yes, but probably fewer than several. Probably just one.

Anon: What if we don’t do that?

Me: Over the next five years, you’ll be successful. And then in year six, the wheels will fall off.

Anon: Are you sure?

Me: No, they could fall off sooner.

Anon: How do you know it will go down like that?

Me: I’ve studied systems and technologies for more than three decades and I’ve made a lot of mistakes. Have you heard of The Voice of Technology?

Anon: No.

Me: Well, take a bite of this – The Voice of Technology. Kevin Kelly has talked about this stuff at great length. Have you read him?

Anon: No.

Me: Here’s a beauty from Kevin – What Technology Wants. How about S-curves?

Anon: Nope.

Me: Here’s a little primer – Beyond Dead Reckoning. How about Technology Forecasting?

Anon: Hmm. I don’t think so.

Me: Here’s something from Victor Fey, my teacher. He worked with Altshuller, the creator of TRIZ – Guided Technology Evolution. I’ve used this method to predict several industry-changing technologies.

Anon: Yikes! There’s a lot here. I’m overwhelmed.

Me: That’s good! Overwhelmed is a sign you realize there’s a lot you don’t know. You could be ready to become a student of the game.

Anon: But where do I start?

Me: I’d start Wardley Maps for situation analysis and LEANSTACK to figure out if customers will pay for your new offering.

Anon: With those two I’m good to go?

Me: Hell no!

Anon: What do you mean?

Me: There’s a whole body of work to learn about. Then you’ve got to build the organization, create the right mindset, select the right projects, train on the right tools, and run the projects.

Anon: That sounds like a lot of work.

Me: Well, you can always do what you did last time. END.

“he went that way matey” by jim.gifford is licensed under CC BY-SA 2.0

Customer Value – the Crowned Jewel of Innovation

Innovation results in things that are novel, useful, and successful. These things can be products, services, data, information, or business models, but regardless of the flavor, they’re all different from what’s been done before.

And when things are different, they’re new; and that means we don’t know how to do them. We don’t know how to start; don’t know how to measure; don’t know how they’ll be received; don’t know if they’ll be successful.

In the commercial domain, successful means customers buy your products and pay for your services. When customers value your new stuff more than they value their money, they pay; and when they pay it’s success. But first things first – before there can be success, before there can be innovation, there must be customer value. With innovation, customer value is front and center.

How do you come up with ideas that may have customer value? There’s a goldmine of ideas out there, with some veins better than others, and any dowsing you can use to pan the high grade ore is time well spent. There are two tools of choice: one that channels the voice of the customer and a second that channels the voice of the technology.

Your technology has evolved over time and has developed a trajectory which you can track. (Innovation On Demand, Fey and Riven.) But at the highest level, as a stand-in for technology, it’s best to track the trajectory of your products – how they’ve improved over time. You can evaluate how your products improved over multiple lines of evolution, and each line will help you to channel the future from a different perspective.

The voice of your customers is the second divining rod of choice. What they say about you, your company, and your products can help you glean what could be. But this isn’t the same as VOC. This is direct, unfiltered, continuous real time capture of self-signified micro stories. This is VOC without the soothsaying, this is direct connection with the customer. (Sensemaker.)

There are two nuggets to pan for: limiting cant’s and purposeful misuse. You seek out groups of customer stories where customers complain about things your product cannot do and how those cant’s limit them. These limiting cant’s are ripe for innovation since your customers already want them. Purposeful misuse is when the radical fringe of your customer base purposely uses your product in a way that’s different than you hoped. These customers have already looked into the future for you.

Do these ideas have customer value? The next step is to evaluate the value of your diamonds in the rough. The main point here is only customers can tell you if you’ve hit the mother lode. But, since your ideas are different than anything they’ve experienced, in order assay the ideas you’ve got to show them. You’ve got to make minimum viable prototypes and let them use their loop to judge the potential cut, color, clarity, and carat. As a prospector, it’s best to evaluate multiple raw gemstones in parallel, and whatever customers say, even if you disagree, the learning is better than gold.

How can we deliver on the customer value? With your innovations in the rough – ideas you know have customer value – it’s time to figure out what it will take to convert your pyrite prototypes into 24 carat products. There are missing elements to be identified and fundamental constraints to be overcome and backplane of the transmutation is problem definition. Done right, the technology development work is a series of well-defined problems with clear definitions of success. From the cleaving, blocking and cutting of technology development the work moves to the polishing of product development and commercialization.

Innovation can’t be fully defined with a three question framework. But, as long as customer value is the crowned jewel of your innovation work, most everything else will fall into place.

Marketing’s Holy Grail – Emerging Customer Needs

The Holy Grail of marketing is to identify emerging customer needs before anyone else and satisfy them to create new markets. It has been a long and fruitless slog as emerging needs have proven themselves elusive. And once candidates are identified, it’s a challenge to agree which are the game-changers and which are the ghosts. There are too many opinions and too few facts. But there’s treasure at the end of the rainbow and the quest continues.

The Holy Grail of marketing is to identify emerging customer needs before anyone else and satisfy them to create new markets. It has been a long and fruitless slog as emerging needs have proven themselves elusive. And once candidates are identified, it’s a challenge to agree which are the game-changers and which are the ghosts. There are too many opinions and too few facts. But there’s treasure at the end of the rainbow and the quest continues.

Emerging things are just coming to be, just starting, so they appy to just a small subset of customers; and emerging things are new and different, so they’re unfamiliar. Unfamiliar plus small same size equals elusive.

I don’t believe in emerging customer needs, I believe in emergent customer behavior.

Emergent behavior is based on actions taken (past tense) and is objectively verifiable. Yes or no, did the customer use the product in a new way? Yes or no, did the customer make the product do something it wasn’t supposed to? Did they use it in a new industry? Did they modify the product on their own? Did they combine it with something altogether unrelated? No argument.

When you ask a customer how to improve your product, their answers aren’t all that important to them. But when a customer takes initiative and action, when they do something new and different with your product, it’s important to them. And even when just a few rouge customers take similar action, it’s worth understanding why they did it – there’s a good chance there’s treasure at the end of that rainbow.

With traditional VOC methods, it has been cost prohibitive to visit enough customers to learn about a handful at the fringes doing the same crazy new thing with your product. Also, with traditional VOCs, these “outliers” are thrown out because they’re, well, they’re outliers. But emergent behavior comes from these very outliers. New information streams and new ways to visualize them are needed to meet these challenges.

For these new information streams, think VOC without the travel; VOC without leading the witness; VOC where the cost of capturing their stories is so low there are so many stories captured that it’s possible to collect a handful of outliers doing what could be the seed for the next new market.

To reduce the cost of acquisition, stories are entered using an app on a smart phone; to let emergent themes emerge, customers code their own stories with a common, non-biasing set of attributes; and to see patterns and outliers, the coded stories are displayed visually.

In the past, the mechanisms to collect and process these information streams did not exist. But they do now.

I hope you haven’t given up on the possibility of understanding what your customers will want in the near future, because it’s now possible.

I urge you to check out SenseMaker.

It’s a tough time to be a CEO

2009 is a tough year, especially for CEOs.

CEOs have a strong desire to do what it takes to deliver shareholder value, but that’s coupled with a deep concern that tough decisions may dismantle the company in the process.

Here is the state-of-affairs:

Sales are down and money is tight. There is severe pressure to cut costs including those that are linked to sales – marketing budgets, sales budgets, travel – and things that directly impact customers – technical service, product manuals, translations, and warranty.

Pricing pressure is staggering. Customers are exerting their buying power – since so few are buying they want to name their price (and can). Suppliers, especially the big ones, are using their muscle to raise prices.

Capacity utilization is ultra-low, so the bounce-back of new equipment sales is a long way off.

Everyone wants to expand into new markets to increase sales, but this is a particularly daunting task with competitors hunkering down to retain market share, cuts in sales and marketing budgets, and hobbled product development engines.

There is a desire to improve factory efficiency to cut costs (rather than to increase throughput like in 2008), but no one wants to spend money to make money – payback must be measured in milliseconds.

So what’s a CEO to do? Read the rest of this entry »

Assess Design Alternatives With Axiomatic Design

Al Hamilton, of Axiomatic Design Solutions, wrote a good article on how Axiomatic Design can be used to evaluate multiple design alternatives.

Here is an excerpt from the article:

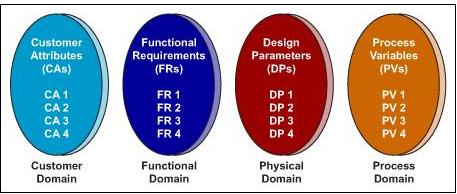

Axiomatic design breaks the design process into four domains, shown in Figure 1. The customer domain can be thought of as the voice of the customer (VOC).

- The functional domain is initially populated by mapping the VOC into independent measurable functions. High-level functions are driven by the customer; lower-level functions are driven by design choices. Every function must be measurable.

- The physical domain is the domain of physics, chemistry, math and algorithms.

- The process domain is where the specifics of how the design parameters identified in the physical domain will be implemented.

Dr. Mike Shipulski, director of engineering at Hypertherm, a manufacturer of plasma cutting systems, has made extensive use of axiomatic design. Shipulski observes, “By first defining the functions we are to achieve, we align our problem solving on the right areas and broaden possible design opportunities. With axiomatic design, we have a framework for avoiding problems that are often detected only during system-level testing.”

Mike Shipulski

Mike Shipulski