Archive for the ‘Cost Savings’ Category

Too Much of a Good Thing

Product cost reduction is a good thing.

Product cost reduction is a good thing.

Too much focus on product cost reduction prevents product enhancements, blocks new customer value propositions, and stifles top-line growth.

Voice of the Customer (VOC) activities are good.

Because customers don’t know what’s possible, too much focus on VOC silences the Voice of the Technology (VOT), blocks new technologies, and prevents novel value propositions. Just because customers aren’t asking for it doesn’t mean they won’t love it when you offer it to them.

Standard work is highly effective and highly productive.

When your whole company is focused on standard work, novelty is squelched, new ideas are scuttled, and new customer value never sees the light of day.

Best practices are highly effective and highly productive.

When your whole company defaults to best practices, novel projects are deselected, risk is radically reduced (which is super risky), people are afraid to try new things and use their judgment, new products are just like the old ones (no sizzle), and top-line growth is gifted to your competitors.

Consensus-based decision-making reduces bad decisions.

In domains of high uncertainty, consensus-based decision-making reduces projects to the lowest common denominator, outlaws the use of judgment and intuition, slows things to a crawl, and makes your most creative people leave the company.

Contrary to Mae West’s maxim, too much of a good thing isn’t always wonderful.

Image credit — Krassy Can Do It

You are defined by the problems you solve.

You can solve problems that reduce the material costs of your products.

You can solve problems that reduce the material costs of your products.

You can solve problems that reduce the number of people that work at your company.

You can solve problems that save your company money.

You can solve problems that help your customers make progress.

You can solve problems that make it easier for your customers to buy from you.

You can solve too many small problems and too few big problems.

You can solve problems that ripple profits through your whole organization.

You can solve local problems.

You can solve problems that obsolete your best products.

You can solve problems that extend and defend your existing products.

You can solve problems that spawn new businesses.

You can solve the wrong problems.

You can solve problems before their time or after it is too late.

You can solve problems that change your company or block it from change.

You are defined by the problems you solve. So, which type of problems do you solve and how do you feel about that?

Image credit – Maureen Barlin

Radical Cost Reduction and Reinvented Supply Chains

As geopolitical pressures rise, some countries that supply the parts that make up your products may become nonviable. What if there was a way to reinvent the supply chain and move it to more stable regions? And what if there was a way to guard against the use of child labor in the parts that make up your product? And what if there was a way to shorten your supply chain so it could respond faster? And what if there was a way to eliminate environmentally irresponsible materials from your supply chain?

As geopolitical pressures rise, some countries that supply the parts that make up your products may become nonviable. What if there was a way to reinvent the supply chain and move it to more stable regions? And what if there was a way to guard against the use of child labor in the parts that make up your product? And what if there was a way to shorten your supply chain so it could respond faster? And what if there was a way to eliminate environmentally irresponsible materials from your supply chain?

Our supply chains source parts from countries that are less than stable because the cost of the parts made in those countries is low. And child labor can creep into our supply chains because the cost of the parts made with child labor is low. And our supply chains are long because the countries that make parts with the lowest costs are far away. And our supply chains use environmentally irresponsible materials because those materials reduce the cost of the parts.

The thing with the supply chains is that the parts themselves govern the manufacturing processes and materials that can be used, they dictate the factories that can be used and they define the cost. Moving the same old parts to other regions of the world will do little more than increase the price of the parts. If we want to radically reduce cost and reinvent the supply chain, we’ve got to reinvent the parts.

There are methods that can achieve radical cost reduction and reinvent the supply chain, but they are little known. The heart of one such method is a functional model that fully describes all functional elements of the system and how they interact. After the model is complete, there is a straightforward, understandable, agreed-upon definition of how the product functions which the team uses to focus the go-forward design work. And to help them further, the method provides guidelines and suggestions to prioritize the work.

I think radical cost reduction and more robust supply chains are essential to a company’s future. And I am confident in the ability of the methods to deliver solid results. But what I don’t know is: Is the need for radical cost reduction strong enough to cause companies to adopt these methods?

“Zen” by g0upil is licensed under CC BY-SA 2.0.

The best time to design cost out of our products is now.

With inflation on the rise and sales on the decline, the time to reduce costs is now.

With inflation on the rise and sales on the decline, the time to reduce costs is now.

But before you can design out the cost you’ve got to know where it is. And the best way to do that is to create a Pareto chart that defines product cost for each subassembly, with the highest cost subassemblies on the left and the lowest cost on the right. Here’s a pro tip – Ignore the subassemblies on the right.

Use your costed Bill of Materials (BOMs) to create the Paretos. You’ll be told that the BOMs are wrong (and they are), but they are right enough to learn where the cost is.

For each of the highest-cost subassemblies, create a lower-level Pareto chat that sorts the cost of each piece-part from highest to lowest. The pro tip applies here, too – Ignore the parts on the right.

Because the design community designed in the cost, they are the ones who must design it out. And to help them prioritize the work, they should be the ones who create the Pareto charts from the BOMs. They won’t like this idea, but tell them they are the only ones who can secure the company’s future profits and buy them lots of pizza.

And when someone demands you reduce labor costs, don’t fall for it. Labor cost is about 5% of the product cost, so reducing it by half doesn’t get you much. Instead, make a Pareto chart of part count by subassembly. Focus the design effort on reducing the part count of subassemblies on the left. Pro tip – Ignore the subassemblies on the right. The labor time to assemble parts that you design out is zero, so when demand returns, you’ll be able to pump out more products without growing the footprint of the factory. But, more importantly, the cost of the parts you design out is also zero. Designing out the parts is the best way to reduce product costs.

Pro tip – Set a cost reduction goal of 35%. And when they complain, increase it to 40%.

In parallel to the design work to reduce part count and costs, design the test fixtures and test protocols you’ll use to make sure the new, lower-cost design outperforms the existing design. Certainly, with fewer parts, the new one will be more reliable. Pro tip – As soon as you can, test the existing design using the new protocols because the only way to know if the new one is better is to measure it against the test results of the old one.

And here’s the last pro tip – Start now.

Image credit — aisletwentytwo

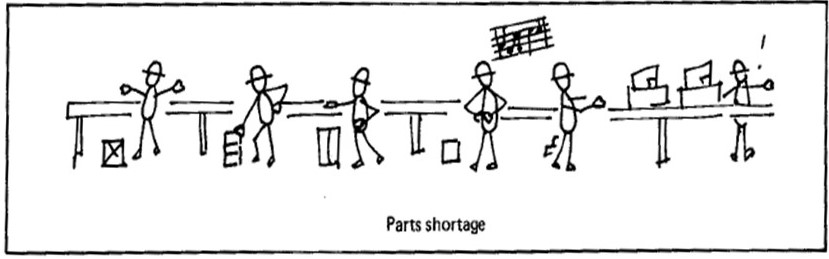

Supply chains don’t have to break.

We’ve heard a lot about long supply chains that have broken down, parts shortages, and long lead times. Granted, supply chains have been stressed, but we’ve designed out any sort of resiliency. Our supply chains are inflexible, our products are intolerant to variation and multiple sources for parts, and our organizations have lost the ability to quickly and effectively redesign the product and the parts to address issues when they arise. We’ve pushed too hard on traditional costing and have not placed any value on flexibility. And we’ve pushed too hard on efficiency and outsourced our design capability so we can no longer design our way out of problems.

We’ve heard a lot about long supply chains that have broken down, parts shortages, and long lead times. Granted, supply chains have been stressed, but we’ve designed out any sort of resiliency. Our supply chains are inflexible, our products are intolerant to variation and multiple sources for parts, and our organizations have lost the ability to quickly and effectively redesign the product and the parts to address issues when they arise. We’ve pushed too hard on traditional costing and have not placed any value on flexibility. And we’ve pushed too hard on efficiency and outsourced our design capability so we can no longer design our way out of problems.

Our supply chains are inflexible because that’s how we designed them. The products cannot handle parts from multiple suppliers because that’s how we designed them. And the parts cannot be made by multiple suppliers because that’s how we designed them.

Now for the upside. If we want a robust supply chain, we can design the product and the parts in a way that makes a robust supply chain possible. If we want the flexibility to use multiple suppliers, we can design the product and parts in a way that makes it possible. And if we want the capability to change the product to adapt to unforeseen changes, we can design our design organizations to make it possible.

There are established tools and methods to help the design community design products in a way that creates flexibility in the supply chain. And those same tools and methods can also help the design community create products that can be made with parts from multiple suppliers. And there are teachers who can help rebuild the design community’s muscles so they can change the product in ways to address unforeseen problems with parts and suppliers.

How much did it cost you when your supply chain dried up? How much did it cost you the last time a supplier couldn’t deliver your parts? How much did it cost you when your design community couldn’t redesign the product to keep the assembly line running? Would you believe me if I told you that all those costs are a result of choices you made about how to design your supply chain, your product, your parts, and your engineering community?

And would you believe me if I told you could make all that go away? Well, even if you don’t believe me, the potential upside of making it go away is so significant you may want to look into it anyway.

Image credit — New Manufacturing Challenge, Suzaki, 1987.

Wrong Questions to Ask When Doing Technology Development

I know you’re trying to do something that has never been done before, but when will you be done? I don’t know. We’ll run the next experiment then decide what to do next. If it works, we’ll do more of that. And if it doesn’t, we’ll do less of that. That’s all we know right now.

I know you’re trying to do something that has never been done before, but when will you be done? I don’t know. We’ll run the next experiment then decide what to do next. If it works, we’ll do more of that. And if it doesn’t, we’ll do less of that. That’s all we know right now.

I know you’re trying to create something that is new to our industry, but how many will we sell? I don’t know. Initial interviews with customers made it clear that this is an important customer problem. So, we’re trying to figure out if the technology can provide a viable solution. That’s all we know right now.

No one is asking for that obscure technology. Why are you wasting time working on that? Well, the voice of the technology and the S-curve analyses suggest the technology wants to move in this direction, so we’re investing this solution space. It might work and it might not. That’s all we know right now.

Why aren’t you using best practices? If it hasn’t been done before, there can be no best practice. We prefer to use good practice or emergent practice.

There doesn’t seem like there’s been much progress. Why aren’t you running more experiments? We don’t know which experiments to run, so we’re taking some time to think about what to do next.

Will it work? I don’t know.

That new technology may obsolete our most profitable product line. Shouldn’t you stop work on that? No. If we don’t obsolete our best work, someone else will. Wouldn’t it be better if we did the obsoleting?

How many more people do you need to accelerate the technology development work? None. Small teams are better.

Sure, it’s a cool technology, but how much will it cost? We haven’t earned the right to think about the cost. We’re still trying to make it work.

So, what’s your solution? We don’t know yet. We’re still trying to formulate the customer problem.

You said you’d be done two months ago. Why aren’t you done yet? I never said we’d be done two months ago. You asked me for a completion date and I could not tell you when we’d be done. You didn’t like that answer so I suggested that you choose your favorite date and put that into your spreadsheet. We were never going to hit that date, and we didn’t.

We’ve got a tight timeline. Why are you going home at 5:00? We’ve been working on this technology for the last two years. This is a marathon. We’re mentally exhausted. See you tomorrow.

If you don’t work harder, we’ll get someone else to do the technology development work. What do you think about that? You are confusing activity with progress. We are doing the right analyses and the right thinking and we’re working hard. But if you’d rather have someone else lead this work, so would I.

We need a patented solution. Will your solution be patentable? I don’t know because we don’t yet have a solution. And when we do have a solution, we still won’t know because it takes a year or three for the Patent Office to make that decision.

So, you’re telling me this might not work? Yes. That’s what I’m telling you.

So, you don’t know when you’ll be done with the technology work, you don’t know how much the technology will cost, you don’t know if it will be patentable, or who will buy it? That’s about right.

Image credit — Virtual EyeSee

Transcending a Culture of Continuous Improvement

We’ve been too successful with continuous improvement. Year-on-year, we’ve improved productivity and costs. We’ve improved on our existing products, making them slightly better and adding features.

Our recipe for success is the same as last year plus three percent. And because the customers liked the old one, they’ll like the new one just a bit more. And the sales can sell the new one because its sold the same way as the old one. And the people that buy the new one are the same people that bought the old one.

Continuous improvement is a tried-and-true approach that has generated the profits and made us successful. And everyone knows how to do it. Start with the old one and make it a little better. Do what you did last time (and what you did the time before). The trouble is that continuous improvement runs out of gas at some point. Each year it gets harder to squeeze out a little more and each year the return on investment diminishes. And at some point, the same old improvements don’t come. And if they do, customers don’t care because the product was already better than good enough.

But a bigger problem is that the company forgets to do innovative work. Though there’s recognition it’s time to do something different, the organization doesn’t have the muscles to pull it off. At every turn, the organization will revert to what it did last time.

It’s no small feat to inject new work into a company that has been successful with continuous improvement. A company gets hooked on the predictable results of continuous which grows into an unnatural aversion to all things different.

To start turning the innovation flywheel, many things must change. To start, a team is created and separated from the continuously improving core. Metrics are changed, leadership is changed and the projects are changed. In short, the people, processes, and tools must be built to deal with the inherent uncertainty that comes with new work.

Where continuous improvement is about the predictability of improving what is, innovation is about the uncertainty of creating what is yet to be. And the best way I know to battle uncertainty is to become a learning organization. And the best way to start that journey is to create formal learning objectives.

Define what you want to learn but make sure you’re not trying to learn the same old things. Learn how to create new value for customers; learn how to deliver that value to new customers; learn how to deliver that new value in new ways (new business models.)

If you’re learning the same old things in the same old way, you’re not doing innovation.

Additive Manufacturing’s Holy Grail

The holy grail of Additive Manufacturing (AM) is high volume manufacturing. And the reason is profit. Here’s the governing equation:

The holy grail of Additive Manufacturing (AM) is high volume manufacturing. And the reason is profit. Here’s the governing equation:

(Price – Cost) x Volume = Profit

The idea is to sell products for more than the cost to make them and sell a lot of them. It’s an intoxicatingly simple proposition. And as long as you look only at the volume – the number of products sold per year – life is good. Just sell more and profits increase. But for a couple reasons, it’s not that simple. First, volume is a result. Customers buy products only when those products deliver goodness at a reasonable price. And second, volume delivers profit only when the cost is less than the price. And there’s the rub with AM.

Here’s a rule – as volume increases, the cost of AM is increasingly higher than traditional manufacturing. This is doubly bad news for AM. Not only is AM more expensive, its profit disadvantage is particularly troubling at high volumes. Here’s another rule – if you’re looking to AM to reduce the cost of a part, look elsewhere. AM is not a bottom-feeder technology.

If you want to create profits with AM, use it to increase price. Use it to develop products that do more and sell for more. The magic of AM is that it can create novel shapes that cannot be made with traditional technologies. And these novel shapes can create products with increased function that demand a higher price. For example, AM can create parts with internal features like serpentine cooling channels with fine-scale turbulators to remove more heat and enable smaller products or products that weigh less. Lighter automobiles get better fuel mileage and customers will pay more. And parts that reduce automobile weight are more valuable. And real estate under the hood is at a premium, and a smaller part creates room for other parts (more function) or frees up design space for new styling, both of which demand a higher price.

Now, back to cost. There’s one exception to cost rule. AM can reduce total product cost if it is used to eliminate high cost parts or consolidate multiple parts into a single AM part. This is difficult to do, but it can be done. But it takes some non-trivial cost analysis to make the case. And, because the technology is relatively new, there’s some aversion to adopting AM. An AM conversion can require a lot of testing and a significant cost reduction to take the risk and make the change.

To win with AM, think more function AND consolidation. More (or new) function to support a higher price (and increase volume) and reduced cost to increase profit per part. Don’t do one or the other. Do both. That’s what GE did with its AM fuel nozzle in their new aircraft engines. They combined 20 parts into a single unit which weighed 25 percent less than a traditional nozzle and was more than five times as durable. And it reduced fuel consumption (more function, higher price).

AM is well-established in prototyping and becoming more established in low-volume manufacturing. The holy grail for AM – high volume manufacturing – will become a broad reality as engineers learn how to design products to take advantage of AM’s unique ability to make previously un-makeable shapes and learn to design for radical part consolidation.

More function AND radical part consolidation. Do both.

Image credit – Les Haines

To make the right decision, use the right data.

When it’s time for a tough decision, it’s time to use data. The idea is the data removes biases and opinions so the decision is grounded in the fundamentals. But using the right data the right way takes a lot of disciple and care.

When it’s time for a tough decision, it’s time to use data. The idea is the data removes biases and opinions so the decision is grounded in the fundamentals. But using the right data the right way takes a lot of disciple and care.

The most straightforward decision is a decision between two things – an either or – and here’s how it goes.

The first step is to agree on the test protocols and measure systems used to create the data. To eliminate biases, this is done before any testing. The test protocols are the actual procedural steps to run the tests and are revision controlled documents. The measurement systems are also fully defined. This includes the make and model of the machine/hardware, full definition of the fixtures and supporting equipment, and a measurement protocol (the steps to do the measurements).

The next step is to create the charts and graphs used to present the data. (Again, this is done before any testing.) The simplest and best is the bar chart – with one bar for A and one bar for B. But for all formats, the axes are labeled (including units), the test protocol is referenced (with its document number and revision letter), and the title is created. The title defines the type of test, important shared elements of the tested configurations and important input conditions. The title helps make sure the tested configurations are the same in the ways they should be. And to be doubly sure they’re the same, once the graph is populated with the actual test data, a small image of the tested configurations can be added next to each bar.

The configurations under test change over time, and it’s important to maintain linkage between the test data and the tested configuration. This can be accomplished with descriptive titles and formal revision numbers of the test configurations. When you choose design concept A over concept B but unknowingly use data from the wrong revisions it’s still a data-driven decision, it’s just wrong one.

But the most important problem to guard against is a mismatch between the tested configuration and the configuration used to create the cost estimate. To increase profit, test results want to increase and costs wants to decrease, and this natural pressure can create divergence between the tested and costed configurations. Test results predict how the configuration under test will perform in the field. The cost estimate predicts how much the costed configuration will cost. Though there’s strong desire to have the performance of one configuration and the cost of another, things don’t work that way. When you launch you’ll get the performance of AND cost of the configuration you launched. You might as well choose the configuration to launch using performance data and cost as a matched pair.

All this detail may feel like overkill, but it’s not because the consequences of getting it wrong can decimate profitability. Here’s why:

Profit = (price – cost) x volume.

Test results predict goodness, and goodness defines what the customer will pay (price) and how many they’ll buy (volume). And cost is cost. And when it comes to profit, if you make the right decision with the wrong data, the wheels fall off.

Image credit – alabaster crow photographic

Product Thinking

Product costs, without product thinking, drop 2% per year. With product thinking, product costs fall by 50%, and while your competitors’ profit margins drift downward, yours are too high to track by conventional methods. And your company is known for unending increases in stock price and long term investment in all the things that secure the future.

The supply chain, without product thinking, improves 3% per year. With product thinking, longest lead processes are eliminated, poorest yield processes are a thing of the past, problem suppliers are gone, and your distributers associate your brand with uninterrupted supply and on time delivery.

Product robustness, without product thinking, is the same year-on-year. Re-injecting long forgotten product thinking to simplify the product, product robustness jumps to unattainable levels and warranty costs plummet. And your brand is known for products that simply don’t break.

Rolled throughput yield is stalled at 90%. With product thinking, the product is simplified, opportunities for defects are reduced, and throughput skyrockets due to improved RTY. And your brand is known as a good value – providing good, repeatable functionality at a good price.

Lean, without product thinking has delivered wonderful results, but the low hanging fruit is gone and lean is moving into the back office. With product thinking, the design is changed and value-added work is eliminated along with its associated non-value added work (which is about 8 times bigger); manufacturing monuments with their long changeover times are ripped out and sold to your competitors; work from two factories is consolidated into one; new work is taken on to fill the emptied factories; and profit per square foot triples. And your brand is known for best-in-class quality, unbeatable on time delivery, world class performance, and pioneering the next generation of lean.

The sales argument is low price and good payment terms. With product thinking, the argument starts with product performance and ends with product reliability. The sales team is energized, and your brand is linked with solid products that just plain work.

The marketing approach is stickers and new packaging. With product thinking, it’s based on competitive advantage explained in terms of head-to-head performance data and a richer feature set. And your brand stands for winning technology and killer products.

Product thinking isn’t for everyone. But for those that try – your brand will thank you.

Fix The Economy – Connect The Engineer To The Factory

Rumor has it, manufacturing is back. Yes, manufacturing jobs are coming back, but they’re coming back in dribbles. (They left in a geyser, so we still have much to do.) What we need is a fire hose of new manufacturing jobs.

Rumor has it, manufacturing is back. Yes, manufacturing jobs are coming back, but they’re coming back in dribbles. (They left in a geyser, so we still have much to do.) What we need is a fire hose of new manufacturing jobs.

Manufacturing jobs are trickling back from low cost countries because companies now realize the promised labor savings are not there and neither is product quality. But a trickle isn’t good enough; we need to turn the tide; we need the Mississippi river.

For flow like that we need a fundamental change. We need labor costs so low our focus becomes good quality; labor costs so low our focus becomes speed to market; labor costs so low our focus becomes speed to customer. But the secret is not labor rate. In fact, the secret isn’t even in the factory.

The secret is a secret because we’ve mistakenly mapped manufacturing solely to making (to factories). We’ve forgotten manufacturing is about designing and making. And that’s the secret: designing – adding product thinking to the mix. Design out the labor.

There are many names for designing and making done together. Most commonly it’s called concurrent engineering. Though seemingly innocuous, taken together, those words have over a thousand meanings layered with even more nuances. (Ask someone for a simple description of concurrent engineering. You’ll see.) It’s time to take a step back and demystify designing and making done together. We can do this with two simple questions:

- What behavior do we want?

- How do we get it?

What’s the behavior we want? We want design engineers to understand what drives cost in the factory (and suppliers’ factories) and design out cost. In short, we want to connect the engineer to the factory.

Great idea. But what if the factory and engineer are separated by geography? How do we get the behavior we want? We need to create a stand-in for the factory, a factory surrogate, and connect the engineer to the surrogate. And that surrogate is cost. (Cost is realized in the factory.) We get the desired behavior when we connect the engineer to cost.

When we make engineering responsible for cost (connect them to cost), they must figure out where the cost is so they can design it out. And when they figure out where the cost is, they’re effectively connected to the factory.

But the engineers don’t need to understand the whole factory (or supply chain), they only need to understand places that create cost (where the cost is.) To understand where cost is, they must look to the baseline product – the one you’re making today. To help them understand supply chain costs, ask for a Pareto chart of cost by part number for purchased parts. (The engineers will use cost to connect to suppliers’ factories.) The new design will focus on the big bars on the left of the Pareto – where the supply chain cost is.

To help them understand your factory’s cost, they must make two more Paretos. The first one is a Pareto of part count by major subassembly. Factory costs are high where the parts are – time to put them together. The second is a Pareto chart of process times. Factory costs are high where the time is – machine capacity, machine operators, and floor space.

To make it stick, use design reviews. At the first design review – where their design approach is defined – ask engineering for the three Paretos for the baseline product. Use the Pareto data to set a cost reduction goal of 50% (It will be easily achieved, but not easily believed.) and part count reduction goal of 50%. (Easily achieved.) Here’s a hint for the design review – their design approach should be strongly shaped by the Paretos.

Going forward, at every design review, ask engineering to present the three Paretos (for the new design) and cost and part count data (for the new design.) Engineering must present the data themselves; otherwise they’ll disconnect themselves from the factory.

To seal the deal, just before full production, engineering should present the go-to-production Paretos, cost, and part count data.

What I’ve described may not be concurrent engineering, but it’s the most profitable activity you’ll ever do. And, as a nice side benefit, you’ll help turn around the economy one company at a time.

Mike Shipulski

Mike Shipulski