Posts Tagged ‘Product Design’

Function first, no exceptions.

Before a design can be accused of having too much material and labor costs, it must be able to meet its functional specifications. Before that is accomplished, it’s likely there’s not enough material and labor in the design and more must be added to meet the functional specifications. In that way, it likely doesn’t cost enough. If the cost is right but the design doesn’t work, you don’t have a viable offering.

Before a design can be accused of having too much material and labor costs, it must be able to meet its functional specifications. Before that is accomplished, it’s likely there’s not enough material and labor in the design and more must be added to meet the functional specifications. In that way, it likely doesn’t cost enough. If the cost is right but the design doesn’t work, you don’t have a viable offering.

Before the low-cost manufacturing process can be chosen, the design must be able to do what customers need it to do. If the design does not yet meet its functional specification, it will change and evolve until it can. And once that is accomplished, low-cost manufacturing processes can be selected that fit with the design. Sure, the design might be able to be subtly adapted to fit the manufacturing process, but only as much as it preserves the design’s ability to meet its functional requirements. If you have a low-cost manufacturing process but the design doesn’t meet the specifications, you don’t have anything to sell.

Before a product can function robustly over a wide range of operating conditions, the prototype design must be able to meet the functional requirements at nominal operating conditions. If you’re trying to improve robustness before it has worked the first time, your work is out of sequence.

Before you can predict when the project will be completed, the design must be able to meet its functional requirements. Before that, there’s no way to predict when the product will launch. If you advertise the project completion date before the design is able to meet the functional requirements, you’re guessing on the date.

When your existing customers buy an upgrade package, it’s because the upgrade functions better. If the upgrade didn’t work better, customers wouldn’t buy it.

When your existing customers replace the old product they bought from you with the new one you just launched, it’s because the new one works better. If the new one didn’t work better, customers wouldn’t buy it.

Function first, no exceptions.

Image credit — Mrs Airwolfhound

Radical Cost Reduction and Reinvented Supply Chains

As geopolitical pressures rise, some countries that supply the parts that make up your products may become nonviable. What if there was a way to reinvent the supply chain and move it to more stable regions? And what if there was a way to guard against the use of child labor in the parts that make up your product? And what if there was a way to shorten your supply chain so it could respond faster? And what if there was a way to eliminate environmentally irresponsible materials from your supply chain?

As geopolitical pressures rise, some countries that supply the parts that make up your products may become nonviable. What if there was a way to reinvent the supply chain and move it to more stable regions? And what if there was a way to guard against the use of child labor in the parts that make up your product? And what if there was a way to shorten your supply chain so it could respond faster? And what if there was a way to eliminate environmentally irresponsible materials from your supply chain?

Our supply chains source parts from countries that are less than stable because the cost of the parts made in those countries is low. And child labor can creep into our supply chains because the cost of the parts made with child labor is low. And our supply chains are long because the countries that make parts with the lowest costs are far away. And our supply chains use environmentally irresponsible materials because those materials reduce the cost of the parts.

The thing with the supply chains is that the parts themselves govern the manufacturing processes and materials that can be used, they dictate the factories that can be used and they define the cost. Moving the same old parts to other regions of the world will do little more than increase the price of the parts. If we want to radically reduce cost and reinvent the supply chain, we’ve got to reinvent the parts.

There are methods that can achieve radical cost reduction and reinvent the supply chain, but they are little known. The heart of one such method is a functional model that fully describes all functional elements of the system and how they interact. After the model is complete, there is a straightforward, understandable, agreed-upon definition of how the product functions which the team uses to focus the go-forward design work. And to help them further, the method provides guidelines and suggestions to prioritize the work.

I think radical cost reduction and more robust supply chains are essential to a company’s future. And I am confident in the ability of the methods to deliver solid results. But what I don’t know is: Is the need for radical cost reduction strong enough to cause companies to adopt these methods?

“Zen” by g0upil is licensed under CC BY-SA 2.0.

Testing is an important part of designing.

When you design something, you create a solution to a collection of problems. But it goes far beyond creating the solution. You also must create objective evidence that demonstrates that the solution does, in fact, solve the problems. And the reason to generate this evidence is to help the organization believe that the solution solves the problem, which is an additional requirement that comes with designing something. Without this belief, the organization won’t go out to the customer base and convince them that the solution will solve their problems. If the sales team doesn’t believe, the customers won’t believe.

When you design something, you create a solution to a collection of problems. But it goes far beyond creating the solution. You also must create objective evidence that demonstrates that the solution does, in fact, solve the problems. And the reason to generate this evidence is to help the organization believe that the solution solves the problem, which is an additional requirement that comes with designing something. Without this belief, the organization won’t go out to the customer base and convince them that the solution will solve their problems. If the sales team doesn’t believe, the customers won’t believe.

In school, we are taught to create the solution, and that’s it. Here are the drawings, here are the materials to make it, here is the process documentation to build it, and my work here is done. But that’s not enough.

Before designing the solution, you’ve got to design the tests that create objective evidence that the solution actually works, that it provides the right goodness and it solves the right problems. This is an easy thing to say, but for a number of reasons, it’s difficult to do. To start, before you can design the right tests, you’ve got to decide on the right problems and the right goodness. And if there’s disagreement and the wrong tests are defined, the design community will work in the wrong areas to generate the wrong value. Yes, there will be objective evidence, and, yes, the evidence will create a belief within the organization that problems are solved and goodness is achieved. But when the sales team takes it to the customer, the value proposition won’t resonate and it won’t sell.

Some questions to ask about testing. When you create improvements to an existing product, what is the family of tests you use to characterize the incremental goodness? And a tougher question: When you develop a new offering that provides new lines of goodness and solves new problems, how do you define the right tests? And a tougher question: When there’s disagreement about which tests are the most important, how do you converge on the right tests?

Image credit — rjacklin1975

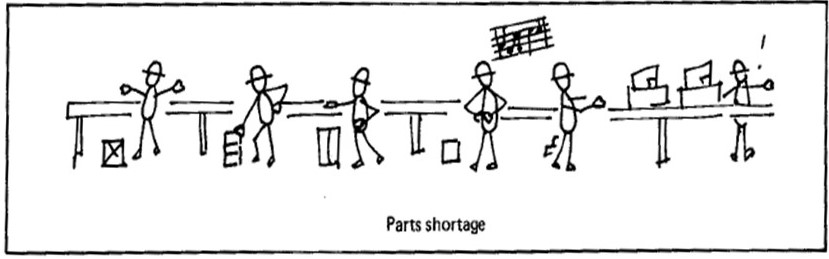

Supply chains don’t have to break.

We’ve heard a lot about long supply chains that have broken down, parts shortages, and long lead times. Granted, supply chains have been stressed, but we’ve designed out any sort of resiliency. Our supply chains are inflexible, our products are intolerant to variation and multiple sources for parts, and our organizations have lost the ability to quickly and effectively redesign the product and the parts to address issues when they arise. We’ve pushed too hard on traditional costing and have not placed any value on flexibility. And we’ve pushed too hard on efficiency and outsourced our design capability so we can no longer design our way out of problems.

We’ve heard a lot about long supply chains that have broken down, parts shortages, and long lead times. Granted, supply chains have been stressed, but we’ve designed out any sort of resiliency. Our supply chains are inflexible, our products are intolerant to variation and multiple sources for parts, and our organizations have lost the ability to quickly and effectively redesign the product and the parts to address issues when they arise. We’ve pushed too hard on traditional costing and have not placed any value on flexibility. And we’ve pushed too hard on efficiency and outsourced our design capability so we can no longer design our way out of problems.

Our supply chains are inflexible because that’s how we designed them. The products cannot handle parts from multiple suppliers because that’s how we designed them. And the parts cannot be made by multiple suppliers because that’s how we designed them.

Now for the upside. If we want a robust supply chain, we can design the product and the parts in a way that makes a robust supply chain possible. If we want the flexibility to use multiple suppliers, we can design the product and parts in a way that makes it possible. And if we want the capability to change the product to adapt to unforeseen changes, we can design our design organizations to make it possible.

There are established tools and methods to help the design community design products in a way that creates flexibility in the supply chain. And those same tools and methods can also help the design community create products that can be made with parts from multiple suppliers. And there are teachers who can help rebuild the design community’s muscles so they can change the product in ways to address unforeseen problems with parts and suppliers.

How much did it cost you when your supply chain dried up? How much did it cost you the last time a supplier couldn’t deliver your parts? How much did it cost you when your design community couldn’t redesign the product to keep the assembly line running? Would you believe me if I told you that all those costs are a result of choices you made about how to design your supply chain, your product, your parts, and your engineering community?

And would you believe me if I told you could make all that go away? Well, even if you don’t believe me, the potential upside of making it go away is so significant you may want to look into it anyway.

Image credit — New Manufacturing Challenge, Suzaki, 1987.

The Most Important People in Your Company

When the fate of your company rests on a single project, who are the three people you’d tap to drag that pivotal project over the finish line? And to sharpen it further, ask yourself “Who do I want to lead the project that will save the company?” You now have a list of the three most important people in your company. Or, if you answered the second question, you now have the name of the most important person in your company.

When the fate of your company rests on a single project, who are the three people you’d tap to drag that pivotal project over the finish line? And to sharpen it further, ask yourself “Who do I want to lead the project that will save the company?” You now have a list of the three most important people in your company. Or, if you answered the second question, you now have the name of the most important person in your company.

The most important person in your company is the person that drags the most important projects over the finish line. Full stop.

When the project is on the line, the CEO doesn’t matter; the General Manager doesn’t matter; the Business Leader doesn’t matter. The person that matters most is the Project Manager. And the second and third most important people are the two people that the Project Manager relies on.

Don’t believe that? Well, take a bite of this. If the project fails, the product doesn’t sell. And if the product doesn’t sell, the revenue doesn’t come. And if the revenue doesn’t come, it’s game over. Regardless of how hard the CEO pulls, the product doesn’t launch, the revenue doesn’t come, and the company dies. Regardless of how angry the GM gets, without a product launch, there’s no revenue, and it’s lights out. And regardless of the Business Leader’s cajoling, the project doesn’t cross the finish line unless the Project Manager makes it happen.

The CEO can’t launch the product. The GM can’t launch the product. The Business Leader can’t launch the product. Stop for a minute and let that sink in. Now, go back to those three sentences and read them out loud. No, really, read them out loud. I’ll wait.

When the wheels fall off a project, the CEO can’t put them back on. Only a special Project Manager can do that.

There are tools for project management, there are degrees in project management, and there are certifications for project management. But all that is meaningless because project management is alchemy.

Degrees don’t matter. What matters is that you’ve taken over a poorly run project, turned it on its head, and dragged it across the line. What matters is you’ve run a project that was poorly defined, poorly staffed, and poorly funded and brought it home kicking and screaming. What matters is you’ve landed a project successfully when two of three engines were on fire. (Belly landings count.) What matters is that you vehemently dismiss the continuous improvement community on the grounds there can be no best practice for a project that creates something that’s new to the world. What matters is that you can feel the critical path in your chest. What matters is that you’ve sprinted toward the scariest projects and people followed you. And what matters most is they’ll follow you again.

Project Managers have won the hearts and minds of the project team.

The Project manager knows what the team needs and provides it before the team needs it. And when an unplanned need arises, like it always does, the project manager begs, borrows, and steals to secure what the team needs. And when they can’t get what’s needed, they apologize to the team, re-plan the project, reset the completion date, and deliver the bad news to those that don’t want to hear it.

If the General Manager says the project will be done in three months and the Project Manager thinks otherwise, put your money on the Project Manager.

Project Managers aren’t at the top of the org chart, but we punch above our weight. We’ve earned the trust and respect of most everyone. We aren’t liked by everyone, but we’re trusted by all. And we’re not always understood, but everyone knows our intentions are good. And when we ask for help, people drop what they’re doing and pitch in. In fact, they line up to help. They line up because we’ve gone out of our way to help them over the last decade. And they line up to help because we’ve put it on the table.

Whether it’s IoT, Digital Strategy, Industry 4.0, top-line growth, recurring revenue, new business models, or happier customers, it’s all about the projects. None of this is possible without projects. And the keystone of successful projects? You guessed it. Project Managers.

Image credit – Bernard Spragg .NZ

To improve innovation, improve clarity.

If I was CEO of a company that wanted to do innovation, the one thing I’d strive for is clarity.

If I was CEO of a company that wanted to do innovation, the one thing I’d strive for is clarity.

For clarity on the innovative new product, here’s what the CEO needs.

Valuable Customer Outcomes – how the new product will be used. This is done with a one page, hand sketched document that shows the user using the new product in the new way. The tool of choice is a fat black permanent marker on an 81/2 x 11 sheet of paper in landscape orientation. The fat marker prohibits all but essential details and promotes clarity. The new features/functions/finish are sketched with a fat red marker. If it’s red, it’s new; and if you can’t sketch it, you don’t have it. That’s clarity.

The new value proposition – how the product will be sold. The marketing leader creates a one page sales sheet. If it can’t be sold with one page, there’s nothing worth selling. And if it can’t be drawn, there’s nothing there.

Customer classification – who will buy and use the new product. Using a two column table on a single page, these are their attributes to define: Where the customer calls home; their ability to pay; minimum performance threshold; infrastructure gaps; literacy/capability; sustainability concerns; regulatory concerns; culture/tastes.

Market classification – how will it fit in the market. Using a four column table on a single page, define: At Whose Expense (AWE) your success will come; why they’ll be angry; what the customer will throw way, recycle or replace; market classification – market share, grow the market, disrupt a market, create a new market.

For clarity on the creative work, here’s what the CEO needs: For each novel concept generated by the Innovation Burst Event (IBE), a single PowerPoint slide with a picture of its thinking prototype and a word description (limited to 12 words).

For clarity on the problems to be solved the CEO needs a one page, image-based definition of the problem, where the problem is shown to occur between only two elements, where the problem’s spacial location is defined, along with when the problem occurs.

For clarity on the viability of the new technology, the CEO needs to see performance data for the functional prototypes, with each performance parameter expressed as a bar graph on a single page along with a hyperlink to the robustness surrogate (test rig), test protocol, and images of the tested hardware.

For clarity on commercialization, the CEO should see the project in three phases – a front, a middle, and end. The front is defined by a one page project timeline, one page sales sheet, and one page sales goals. The middle is defined by performance data (bar graphs) for the alpha units which are hyperlinked to test protocols and tested hardware. For the end it’s the same as the middle, except for beta units, and includes process capability data and capacity readiness.

It’s not easy to put things on one page, but when it’s done well clarity skyrockets. And with improved clarity the right concepts are created, the right problems are solved, the right data is generated, and the right new product is launched.

And when clarity extends all the way to the CEO, resources are aligned, organizational confusion dissipates, and all elements of innovation work happen more smoothly.

Image credit – Kristina Alexanderson

The Threshold Of Uncertainty

Our threshold for uncertainty is too low.

Our threshold for uncertainty is too low.

Early in projects, even before the first prototype is up and running, you know what the product must do, what it will cost, and, most problematic, when you’ll be done. Independent of work content, level of newness, and workloads, there’s no uncertainty in your launch date. It’s etched in stone and the consequences are devastating.

A zero tolerance policy on uncertainty forces irrational behavior. As soon as possible, engineering gets something running in the lab, and then doesn’t want to change it because there’s no time. The prototype is almost impossible to build and is hypersensitive to normal process variation, but these issues are not addressed because there’s no time. Everyone agrees it’s important to fix it, and agrees to fix it after launch, but that never happens because the next project is already late before it starts. And the death cycle repeats project after project.

The root cause of this mess is the mistaken porting of manufacturing’s zero uncertainly mindset into design. The thinking goes like this – lean and Six Sigma have achieved magical success in manufacturing by eliminating uncertainty, so let’s do it in product design and achieve similar results. This is a fundamental mistake as the domains are fundamentally different.

In manufacturing the same product is made day-in and day-out – no uncertainty; in product design no two product development efforts are the same and there’s lots of stuff that’s done for the first time – uncertainty by definition. In manufacturing there’s a revision controlled engineering drawing that defines the right answer (the geometry and the material) – make it like the picture and it’s all good; in product design the material is chosen from many candidates and the geometry is created from scratch – the picture is created from nothing. By definition there’s more inherent uncertainty in product design, and to tighten the screws and fix the launch date at the start is inappropriate.

Design engineers must feel like there’s enough time to try new things because new products that provide new functionality require new technologies, new materials, and new geometries. With new comes inherent uncertainty, but there are ways to manage it.

To hold the timeline, give on the specification and cost. Design as fast as you can until you run out of time then launch. The product won’t work as well as you’d like and it will cost more than you’d like, but you’ll hit the schedule. A good way to do this is to de-feature a subassembly to reduce design time, and possibly reduce cost. Or, reuse a proven subassembly to reduce design time – take a hit in cost, but hit the timeline. The general idea – hold schedule but flex on performance and cost.

It feels like sacrilege to admit that something’s got to give, but it’s the truth. You’ve seen how it goes when you edict (in no uncertain terms) that the timeline will be met and there’ll be no give on performance and cost. It hasn’t worked, and it won’t – the inherent uncertainty of product design won’t let it.

Accept the uncertainty; be one with it; and manage it. It’s the only way.

Innovation Eats Itself

We all want more innovation, though sometimes we’re not sure why. Turns out, the why important.

We all want more innovation, though sometimes we’re not sure why. Turns out, the why important.

We want to be more innovative. That’s a good vision statement, but it’s not actionable. There are lots of ways to be innovative, and it’s vitally important to figure out the best flavor. Why do you want to be more innovative?

We want to be more innovative to grow sales. Okay, that’s a step closer, but not actionable. There are many ways to grow sales. For example, the best and fastest way to sell more units is to reduce the price by half. Is that what you want? Why do you want to grow sales?

We want to be more innovative to grow sales so we can grow profits. Closer than ever, but we’ve got to dig in and create a plan.

First, let’s begin with the end in mind. We’ve got to decide how we’ll judge success. How much do we want to grow profits? Double, you say? Good – that’s clear and measurable. I like it. When will we double profits? In four years, you say? Another good answer – clear and measureable. How much money can we spend to hit the goal? $5 million over four years. And does that incremental spending count against the profit target? Yes, year five must double this year’s profits plus $5 million.

Now that we know the what, let’s put together the how. Let’s start with geography. Will we focus on increasing profits in our existing first world markets? Will we build out our fledgling developing markets? Will we create new third world markets? Each market has different tastes, cultures, languages, infrastructure requirements, and ability to pay. And because of this, each requires markedly different innovations, skill sets, and working relationships. This decision must be made now if we’re to put together the right innovation team and organizational structure.

Now that we’ve decided on geography, will we do product innovation or business model innovation? If we do product innovation, do we want to extend existing product lines, supplement them with new product lines, or replace them altogether with new ones? Based on our geography decision, do we want to improve existing functionality, create new functionality, or reduce cost by 80% of while retaining 80% of existing functionality?

If we want to do business model innovation, that’s big medicine. It will require we throw away some of the stuff that has made us successful. And it will touch almost everyone. If we’re going to take that on, the CEO must take a heavy hand.

For simplicity, I described a straightforward, linear process where the whys are clearly defined and measurable and there’s sequential flow into a step-wise process to define the how. But it practice, there’s nothing simple or linear about the process. At best there’s overwhelming ambiguity around why, what, and when, and at worst, there’s visceral disagreement. And worse, with 0% clarity and an absent definition of success, there are several passionate factions with fully built-out plans that they know will work.

In truth, figuring out what innovation means and making it happen is a clustered-jumbled path where whats inform whys, whys transfigure hows, which, in turn, boomerang back to morph the whats. It’s circular, recursive, and difficult.

Innovation creates things that are novel, useful, and successful. Novel means different, different means change, and change is scary. Useful is contextual – useful to whom and how will they use it? – and requires judgment. (Innovations don’t yet exist, so innovation efforts must move forward on predicted usefulness.) And successful is toughest of all because on top of predicted usefulness sit many other facets of newness that must come together in a predicted way, all of which can be verified only after the fact.

Innovation is a different animal altogether, almost like it eats itself. Just think – the most successful innovations come at the expense of what’s been successful.

Small Is Good, And Powerful

If lean has taught us anything, it’s smaller is better. Smaller machines, smaller factories, smaller teams, smaller everything.

If lean has taught us anything, it’s smaller is better. Smaller machines, smaller factories, smaller teams, smaller everything.

The famous Speaker of the House, Tip O’Neill, said all politics are local. He meant all action happens at the lowest levels (in the districts and neighborhoods), where everyone knows everyone, where the issues are well understood, and the fundamentals are not just talked about, they’re lived. It’s the same with manufacturing. But I’m not talking about local in the geography sense; I’m talking about the neighborhood sense. When manufacturing is neighborhood-local, it’s small, tight, focused and knowledgeable.

We mistakenly think about manufacturing strictly as the process of making things—it’s far more. In the broadest sense, manufacturing is everything: innovation, design, making and service. It’s this broad-sense manufacturing that will deliver the next economic revolution.

Previously, I described how big companies break themselves into smaller operating units. They recognize lean favors small, and they break themselves up for competitive advantage. They want to become a collective of small companies with the upside of small without of the downside of big. Yet with small companies, there’s an urge to be big.

Lean says smaller is better and more profitable. Lean says small companies have an advantage because they’re already small. Lean says small companies should stay small (neighborhood small) and be more of what they are.

Small companies have a size advantage. Their smaller scope improves focus and alignment. It’s easier to define the mission, communicate it, and work toward it. It’s easier to mobilize the neighborhood. It’s clearer when things go off track and easier to get things back on track. At the lowest level, smaller companies zero in on problems and fix them. At the highest, they align themselves with their mission. These are important advantages, but not the most important.

The real advantage is deep process knowledge. Smaller companies have less breadth and more depth, which allows them to focus energy on the work and develop deep process knowledge. Many large manufacturers have lost process knowledge over the years. Small companies tend to develop and retain more of it. We’ve forgotten the value of deep process knowledge, but as companies look for competitive advantage, its stock is rising.

Lean wants small companies to build on that strength. To take it to the next level, lean wants companies to think about manufacturing in the more-than-making sense and use that deep process knowledge to influence the product itself. Lean wants suppliers to inject their process knowledge into their customers’ product development process to radically reduce material cost and help the product sprint through the factory.

The ultimate advantage of deep process knowledge is realized when small companies use it to design products. It’s realized when people who know the process fundamentals work respectfully with their neighbors who design the product. The result is deeper process knowledge and a far more profitable product. Big companies like to work with smaller companies who can design and make.

Tip O’Neill and lean agree. All manufacturing is local. And this local nature drives a focus on the fundamentals and details. Being neighborhood-local is easier for small companies because their scope is smaller, which helps them develop and retain deep process knowledge.

Lean wants companies to be small—neighborhood-small. When small companies build on a foundation of deep process knowledge, sales grow. Lean wants sales growth, but it also wants companies to reduce their size in the neighborhood sense.

Fix The Economy – Connect The Engineer To The Factory

Rumor has it, manufacturing is back. Yes, manufacturing jobs are coming back, but they’re coming back in dribbles. (They left in a geyser, so we still have much to do.) What we need is a fire hose of new manufacturing jobs.

Rumor has it, manufacturing is back. Yes, manufacturing jobs are coming back, but they’re coming back in dribbles. (They left in a geyser, so we still have much to do.) What we need is a fire hose of new manufacturing jobs.

Manufacturing jobs are trickling back from low cost countries because companies now realize the promised labor savings are not there and neither is product quality. But a trickle isn’t good enough; we need to turn the tide; we need the Mississippi river.

For flow like that we need a fundamental change. We need labor costs so low our focus becomes good quality; labor costs so low our focus becomes speed to market; labor costs so low our focus becomes speed to customer. But the secret is not labor rate. In fact, the secret isn’t even in the factory.

The secret is a secret because we’ve mistakenly mapped manufacturing solely to making (to factories). We’ve forgotten manufacturing is about designing and making. And that’s the secret: designing – adding product thinking to the mix. Design out the labor.

There are many names for designing and making done together. Most commonly it’s called concurrent engineering. Though seemingly innocuous, taken together, those words have over a thousand meanings layered with even more nuances. (Ask someone for a simple description of concurrent engineering. You’ll see.) It’s time to take a step back and demystify designing and making done together. We can do this with two simple questions:

- What behavior do we want?

- How do we get it?

What’s the behavior we want? We want design engineers to understand what drives cost in the factory (and suppliers’ factories) and design out cost. In short, we want to connect the engineer to the factory.

Great idea. But what if the factory and engineer are separated by geography? How do we get the behavior we want? We need to create a stand-in for the factory, a factory surrogate, and connect the engineer to the surrogate. And that surrogate is cost. (Cost is realized in the factory.) We get the desired behavior when we connect the engineer to cost.

When we make engineering responsible for cost (connect them to cost), they must figure out where the cost is so they can design it out. And when they figure out where the cost is, they’re effectively connected to the factory.

But the engineers don’t need to understand the whole factory (or supply chain), they only need to understand places that create cost (where the cost is.) To understand where cost is, they must look to the baseline product – the one you’re making today. To help them understand supply chain costs, ask for a Pareto chart of cost by part number for purchased parts. (The engineers will use cost to connect to suppliers’ factories.) The new design will focus on the big bars on the left of the Pareto – where the supply chain cost is.

To help them understand your factory’s cost, they must make two more Paretos. The first one is a Pareto of part count by major subassembly. Factory costs are high where the parts are – time to put them together. The second is a Pareto chart of process times. Factory costs are high where the time is – machine capacity, machine operators, and floor space.

To make it stick, use design reviews. At the first design review – where their design approach is defined – ask engineering for the three Paretos for the baseline product. Use the Pareto data to set a cost reduction goal of 50% (It will be easily achieved, but not easily believed.) and part count reduction goal of 50%. (Easily achieved.) Here’s a hint for the design review – their design approach should be strongly shaped by the Paretos.

Going forward, at every design review, ask engineering to present the three Paretos (for the new design) and cost and part count data (for the new design.) Engineering must present the data themselves; otherwise they’ll disconnect themselves from the factory.

To seal the deal, just before full production, engineering should present the go-to-production Paretos, cost, and part count data.

What I’ve described may not be concurrent engineering, but it’s the most profitable activity you’ll ever do. And, as a nice side benefit, you’ll help turn around the economy one company at a time.

Radically Simplify Your Value Stream – Change Your Design

The next level of factory simplification won’t come from your factory. It will come from outside your factory. The next level of simplification will come from upstream savings – your suppliers’ factories – and downstream savings – your distribution system. And this next level of simplification will create radically shorter value streams (from raw materials to customer.)

The next level of factory simplification won’t come from your factory. It will come from outside your factory. The next level of simplification will come from upstream savings – your suppliers’ factories – and downstream savings – your distribution system. And this next level of simplification will create radically shorter value streams (from raw materials to customer.)

To reinvent your value stream, traditional lean techniques – reduction of non-value added (NVA) time through process change – aren’t the best way. The best way is to eliminate value added (VA) time through product redesign – product change. Reduction of VA time generates a massive NVA savings multiple. (Value streams are mostly NVA with a little VA sprinkled in.) At first this seems like backward thinking (It is bit since lean focuses exclusively on NVA.), but NVA time exists only to enable VA time (VA work). No VA time, no associated NVA time.

Value streams are all about parts (making them, counting them, measuring them, boxing them, moving them, and un-boxing them) and products (making, boxing, moving.) The making – touch time, spindle time – is VA time and everything else is VA time. Design out the parts themselves (VA time) and NVA time is designed out. Massive multiple achieved.

But the design community is the only group that can design out the parts. How to get them involved? Not all parts are created equal. How to choose the ones that matter? Value streams cut across departments and companies. How to get everyone pulling together?

Watch the video: link to video. (And embedded below.)

Mike Shipulski

Mike Shipulski